Emission Model

Sustainable Growth and Scarcity

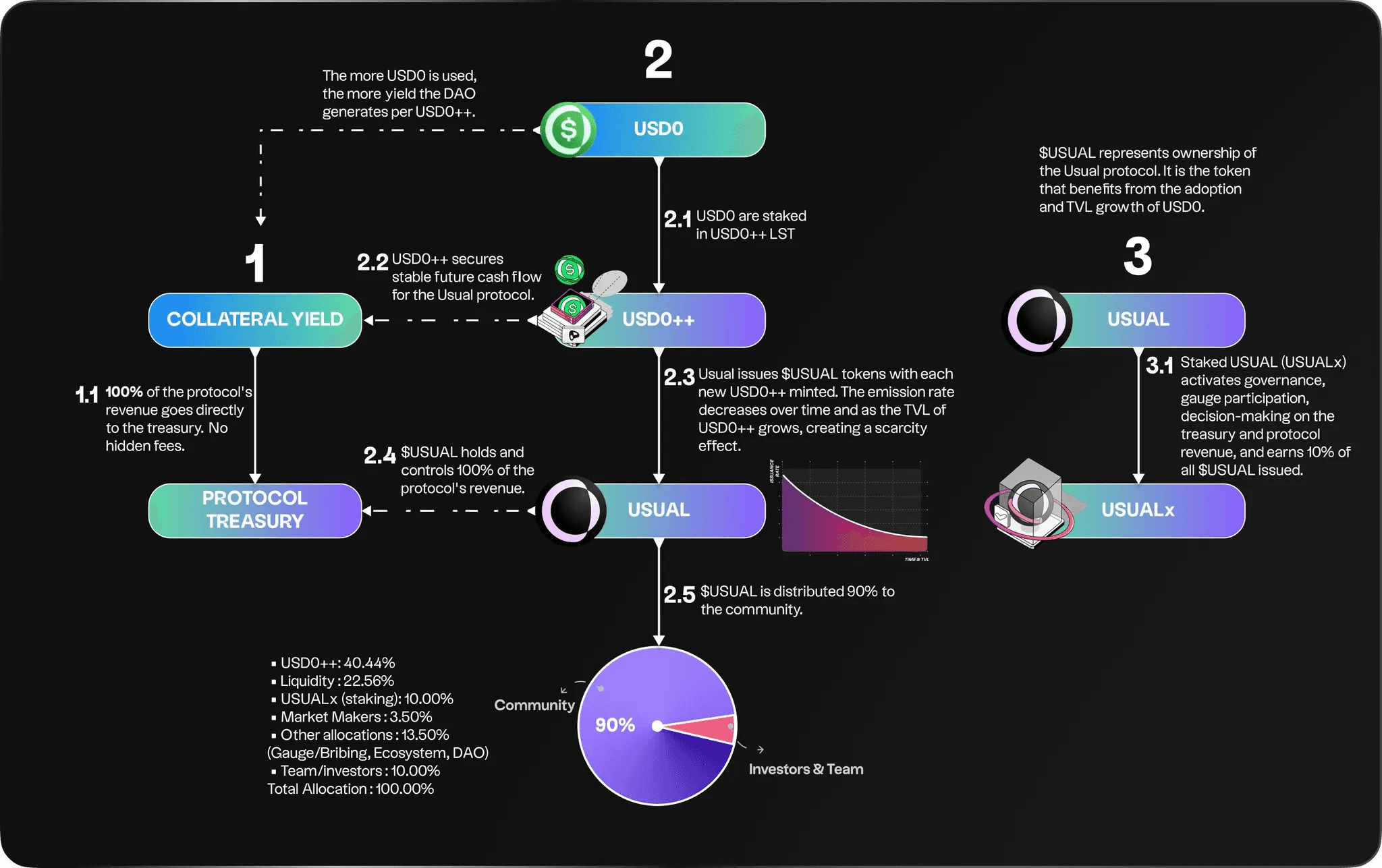

The emission model of $USUAL is designed to promote scarcity and align incentives for early adopters and long-term holders.

Before diving into the emission mechanics, it’s important to note that as the TVL of USD0 grows, the protocol generates more revenue. 100% of these revenues are allocated directly to the protocol’s treasury, with no hidden fees or off-chain charges.

When a user stakes their USD0 (2.1), they are essentially securing the protocol’s future revenue potential. This staking allows the protocol to issue $USUAL tokens, which are only minted against the guarantee of future revenue, ensuring that $USUAL holders are protected from dilution over time. Moreover, the emission of $USUAL is disinflationary: as the TVL of USD0++ increases, the rate of token issuance gradually decreases, further supporting scarcity (2.3). As the protocol’s TVL increases, revenue grows and the treasury accumulates more value. However, the emission rate of $USUAL decreases, reducing the number of tokens issued per locked dollar. This reduction boosts the Earnings Per Token, leading to a natural increase in the price of $USUAL.

Usual enables complete control over 100% of the protocol’s revenue through its treasury, while also offering various utilities that add extra value (2.4). The model is community-focused, with 90% of tokens distributed to the community through mechanisms such as liquidity incentives, ensuring broad participation and alignment with the protocol’s growth (2.5).

In this model, early participants benefit the most, as the decreasing issuance over time favors long-term holders and promotes a more sustainable ecosystem.

Emission Strategy: A New Approach to Tokenomics

The USUAL token uses a dynamic supply-adjusted emission mechanism that adjusts daily emissions based on:

TVL Growth, specifically USD0++ denominated TVL.

Changes in interest rates of assets backing USD0.

The objective is to influence the token supply to increase its intrinsic value over time as the token becomes scarcer. Token emissions are distributed across various channels, known as “buckets,” to align incentives within the ecosystem.

The supply of USUAL does not follow a strict emission schedule. Though more tokens are issued over time, the emission rate fluctuates, remaining significantly lower than the treasury’s growth rate. This ensures that inflation (the increase in token supply) does not lead to dilution.

Key points

Capped emissions: A maximum threshold is set to prevent excess inflation.

The emission rate decreases as the USD0++ supply grows.

Emission adjusts based on interest rates, maintaining fairness for users in both low and high-interest rate periods.

The minting rate adjusts according to TVL growth and interest rate changes and is capped to prevent excessive emissions. The minting rate can further scaled by the DAO via $USUAL governance, highlighting another important right of $USUAL holders.

Last updated